What makes a poor row label

Clear labelling equals clear thinking. Clear thinking equals clear labelling.

It's not very sexy, and it won't win you any prizes. But writing a good label is one of the most underrated skills in financial modelling.

Concise and consistent labelling underpins modelling clarity.

Clear label writing is a sign of clear thinking.

To help you stay on your labelling game, here's my list of what makes a lousy label:

1. Using different words to describe the same thing.

Sometimes it's revenue. Sometimes it's turnover. Sometimes it's sales. And it's all the same thing. Each line item in your model should have a unique label, and you should always use that label. This is one of the ways that linking helps us. We always create the link starting from the row label column. That way, we don't have to remember what we called something when we use it somewhere else. The row label is part of the link.

2. Using the same words to describe different things.

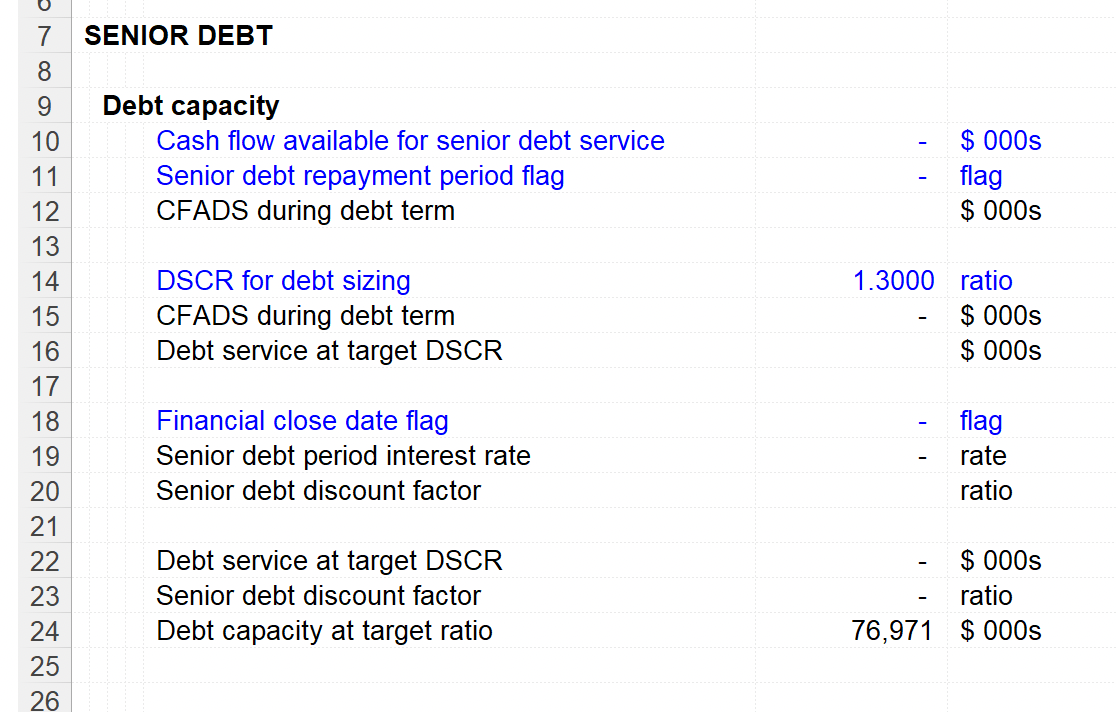

There are four tranches of senior debt and a tranche of Mezz debt in the model, and the calculation of interest for each one is labelled "Interest".

They are all very different numbers, but they all have the same label.

The risk of linking to the wrong one is made much higher by not having unique labels for each one:

- Senior debt tranche 1 interest

- Senior debt tranche 2 interest etc.

And make sure you structure the label the same way each time.

So not:

- Senior debt tranche 1 interest

- Senior debt interest - tranche 2

- Tranche 3 senior debt interest

You are aiming for a high level of specificity while keeping one eye on the length of the label. It's easy to allow the required context and specificity to drive a very long row label.

3. Lots of abbreviations in the labels.

In dealing with the overly long row labels, it's tempting to start abbreviating everything and so -

Senior debt tranche 1 interest

becomes

Snr dbt tr 1 int

The problem with this is that it can become hard to read for others who need to understand your model. It also places an increased workload on you to remember your abbreviations.

4. Inconsistent capitalisation.

Is it Senior Debt Interest? Or Senior debt interest?

Are we capitalising every word in the label? Or just the first word in the label?

It doesn't matter which approach you use.

What matters is that you choose one approach and stick to it.

If there are multiple modellers on your team, ensure that you have a common approach to label capitalisation. It's an easy area where inconsistency can creep into your model.

The capitalisation convention we use on our team

- Section A headers - all capitalised.

- Section B and C headers, first-word capitalisation only

- Row labels - first work capitalisation, with exceptions for acronyms (for example, CFADS)

- Units - not capitalised, unless an acronym.

We have included a capitalisation review tool in the productivity macros to ensure consistency in our labelling. We'll come back to this later in the book.

Comments

Sign in or become a Financial Modelling Handbook member to join the conversation.

Just enter your email below to get a log in link.