Financial modelling is part of a bigger process.

Every financial model starts with a question.

Building a spreadsheet model is always a means to an end.

The purpose of any model is to generate insights to help answer critical business questions.

The model is a laboratory. It's a place where we can test hypotheses about the business. This is why I love modelling. Done well, it can help us explore real-world business dynamics and ultimately make better decisions.

Financial modelling, therefore, is one component of a wider business analysis process.

Tom Grossman developed a helpful framework to describe this process. He called it the Business Analysis Lifecycle.

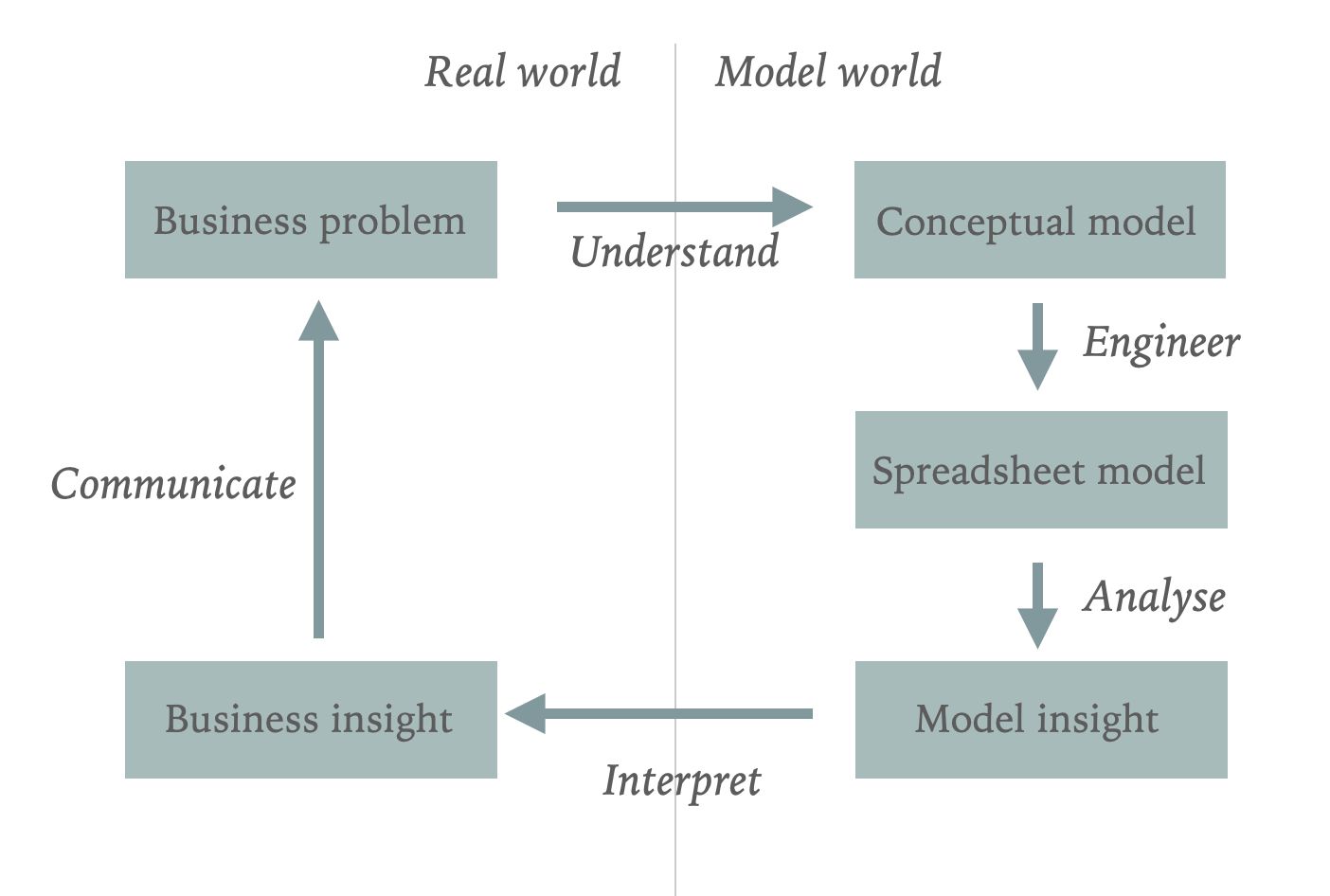

This framework splits the world into two parts; the real world and the model world.

In the real world, we start with a business question.

Questions like how much can we borrow? How much should we pay for this business? How much should we bid?

Before we can do anything, we first need to understand. We need to understand this business, this project, the financing, the operational drivers. We need to understand these things before we can create the spreadsheet model. The spreadsheet is a representation of our conceptual understanding of a business.

Creating the conceptual and spreadsheet models are two different skill sets. It's essential to know the difference between them.

It's crucial to get the technical detail of the model right. However, you're lost if you don't start with a solid conceptual understanding and clarity about what questions you're answering.

It might be that you already have a strong understanding of a particular business, sector, or industry. If not you will need to spend time with people who do to get a firm grasp on how the business works.

The model is not an end in itself

Once we have a solid conceptual understanding and a well "engineered" spreadsheet model, we can use that model to analyse the business. That analysis will allow us to create insights. Ultimately, that’s the reason we build models in the first place.

And once we have those insights, we also have to be able to communicate them to inform the original business problem.

Modelling greatness

To be a great modeller, therefore, requires multiple skill sets:

We need the technical skills to design and build the model.

We also need commercial understanding to know what to model.

We need analytical skills to uncover and interpret useful insights.

And finally, we need the presentational skills to communicate the end results.

I have huge admiration for great modellers.

Comments

Sign in or become a Financial Modelling Handbook member to join the conversation.

Just enter your email below to get a log in link.