Circularity in our tax calculation

Our tax calculations actually create two separate circularities:

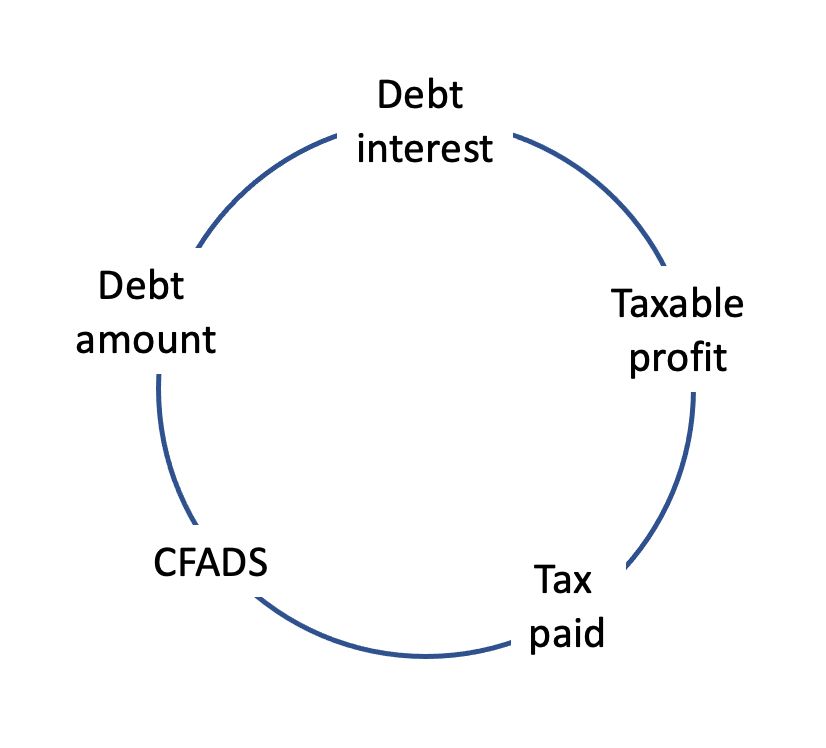

Circularity 1: Debt sizing

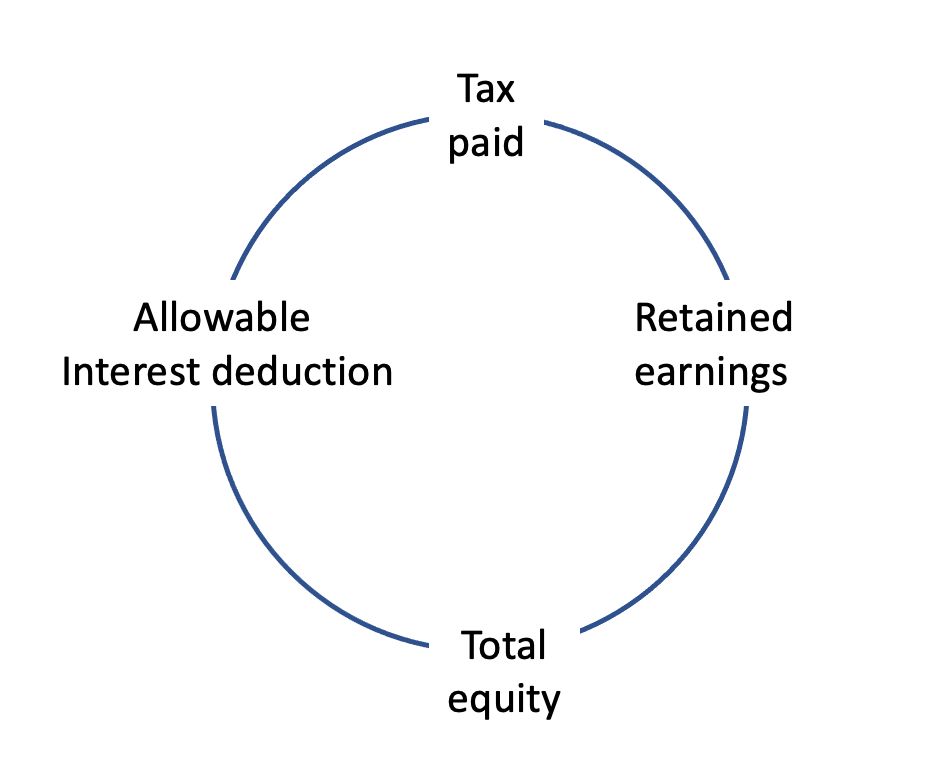

Circularity 2: Disallowable debt interest

If we want to avoid circularities in our model, we will have to ensure that we break both of these.

But why do we want to avoid circularities in our model in the first place?

We'll look at that next before coming back to see how we can break them.

Comments

Sign in or become a Financial Modelling Handbook member to join the conversation.

Just enter your email below to get a log in link.